Iron Condor

Daily Income Potential

Leverages short dated options on the SPX to capture high probability wins with defined risk

Benefits

-

Daily Profit Potential

-

Volatility Advantage

-

Defined Risk

-

No Overnight Risk

Considerations

-

Capped Profit Potential

-

Sensitive to Large Moves

-

High Margin Requirements

-

Execution Risk

Further Info

For the Iron Condor to profit, the market doesn’t need to move in any particular direction. The strategy involves selling an out-of-the-money (OTM) put spread and an OTM call spread simultaneously on the same underlying asset.

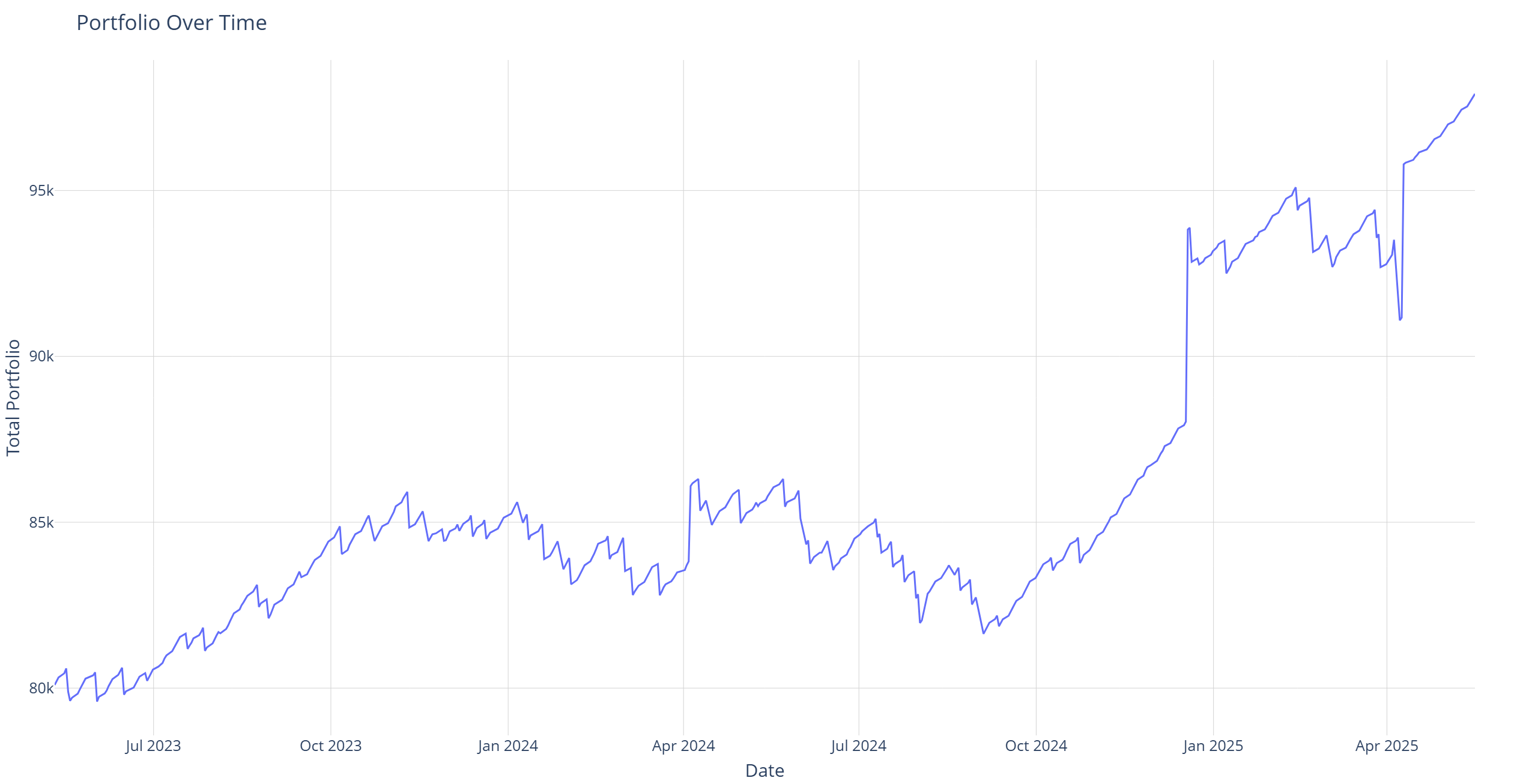

You can see how it works below. However there is nuance in the structure and risk management that impact performance greatly. Leveraging our backtesting engine we have optimized each variable. We learned that with the standard spreads your brokerage might suggest, and not managing stops correctly, this high probability strategy can lose regularly.

To mitigate these pitfalls we have optimized each leg of the spread, when it trades and where to put the stops to and when to let it go. You can follow along here to gain insight to inform your approach.

Bonus Content!

How the Iron Condor Works

The Iron Condor consists of four legs:

-

Sell an OTM Put Option

-

Generates premium income.

-

Strike Price is Below the current market price.

-

-

Buy a Lower Strike OTM Put Option

-

Limits downside risk.

-

Strike price is even further below the market price.

-

-

Sell an OTM Call Option

-

Generates premium income.

-

Strike price above the current market price.

-

-

Buy a Higher Strike OTM Call Option

-

Limits upside risk.

-

Strike price is even further above the market price.

-

Profit and Loss

-

Max Profit: Net premium received if the SPX price stays between the short strikes at expiration.

-

Max Loss: The width of the spread minus the net premium received.

-

Breakeven points:

-

Lower BEP: Lower put strike – net premium received.

-

Upper BEP: Upper call strike + net premium received.

-

Example Trade

SPX is at 5000

-

Sell 4950 Put @ 0.78

-

Buy 4900 Put @ 0.10

-

Sell 5050 Call @ 0.65

-

Buy 5100 Call @ 0.05

Net Premium collected: $1.28 per contract ($128 per spread)

If the SPX stays between 4950 and 5050, you keep the full $128.

If the SPX moves outside that range, losses start accumulating.

Managing Risk: Buying back the Short Strikes

If the market moves against your position, you may need to buy back the short strikes to reduce risk.

-

Rolling the Losing Side

-

If the SPX moves upward and the 5050 call becomes ITM, buy it back and roll to a higher strike to increase room for profit.

-

If the SPX moves downward and the 4950 put becomes ITM, buy it back and roll to a lower strike to increase room for profit.

-

This adjustment is often made for a net credit to maintain a favorable risk-reward.

-

-

Closing the Losing Side Early

-

If the SPX moves close to your short strike but hasn’t broken it yet, consider buying back the short option before it goes deep ITM to prevent maximum loss.

-

This can be done at a 50-75% loss threshold to limit further damage.

-

-

Hedging with a Long Option or Future

-

If the SPX is trending toward one side, you can hedge by buying a long option (a call or put) to offset losses.

-

Futures can also be used if you are trading indexes like SPX, NDX, or RUT.

-